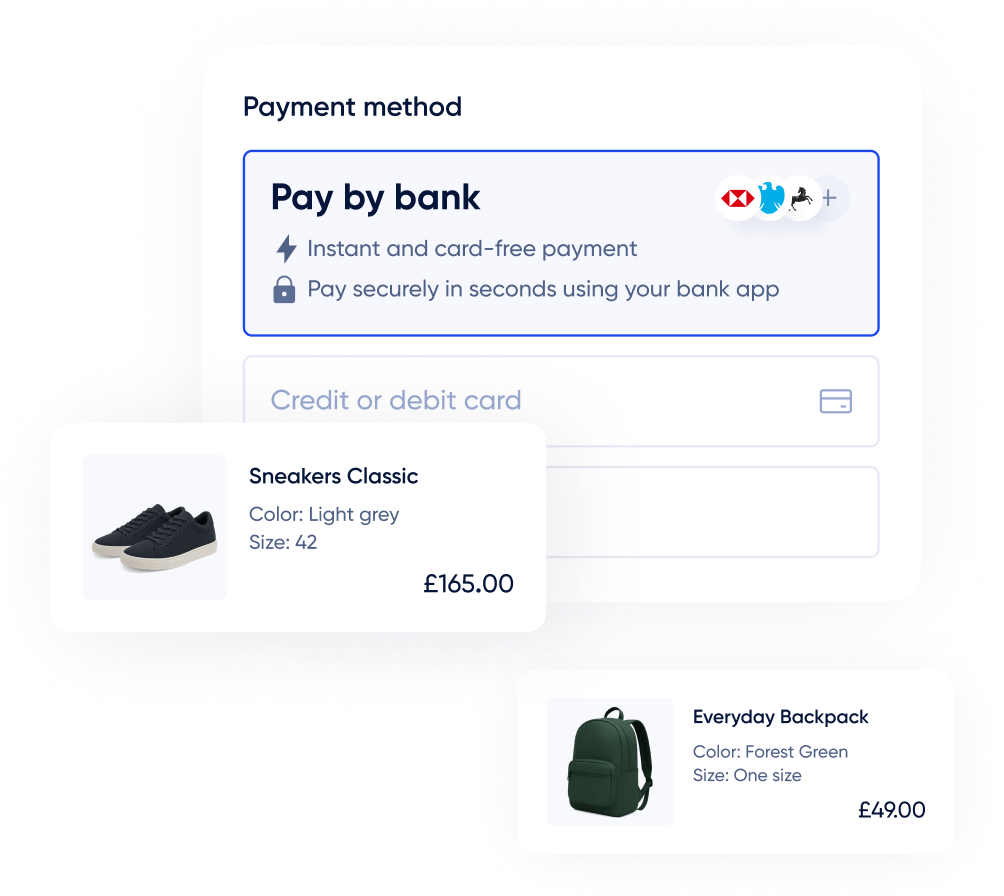

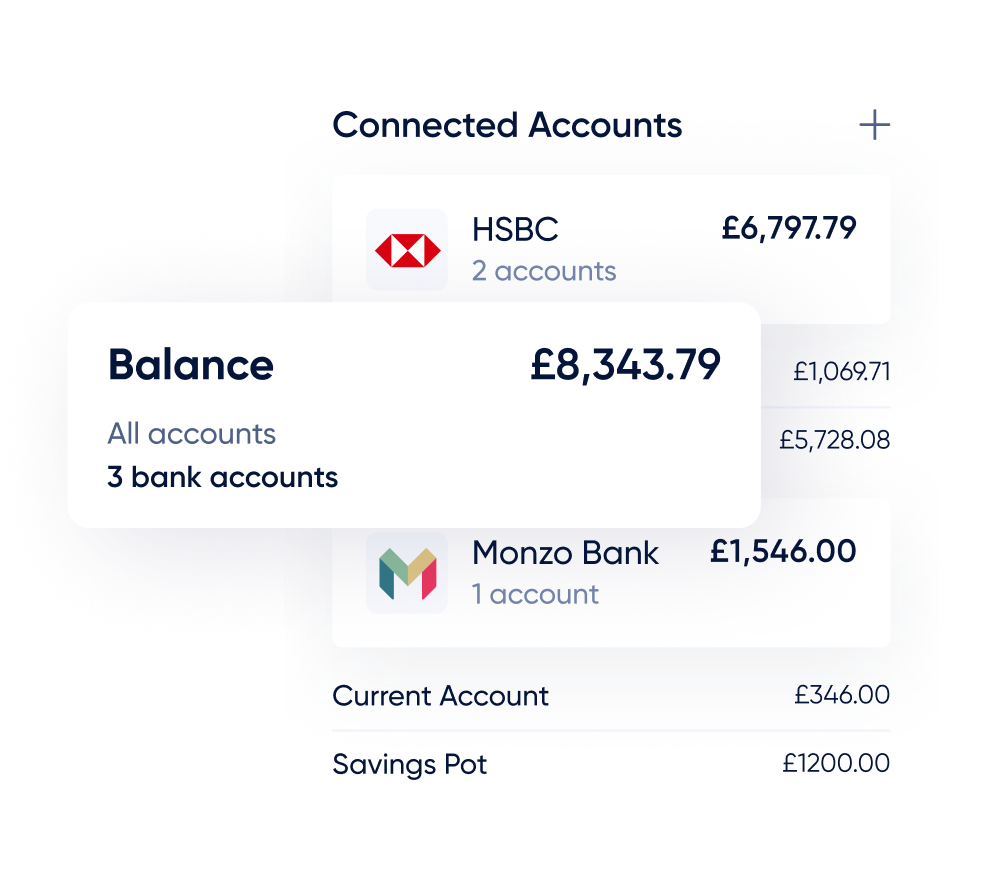

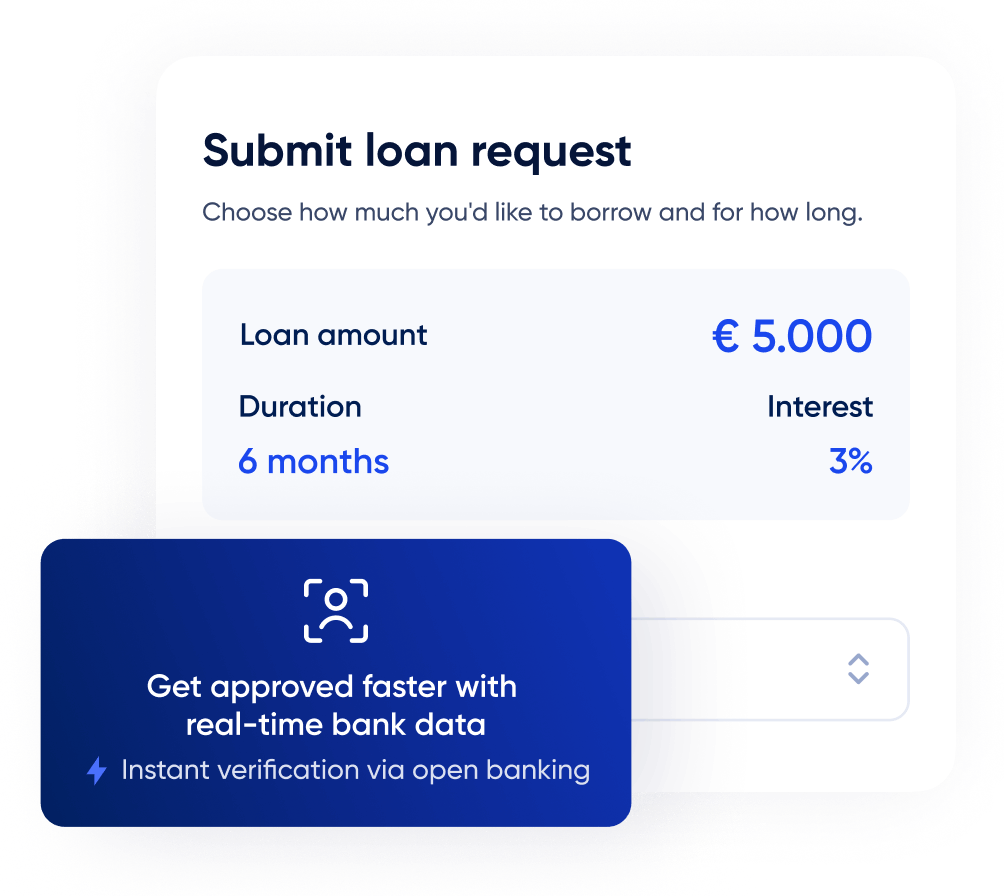

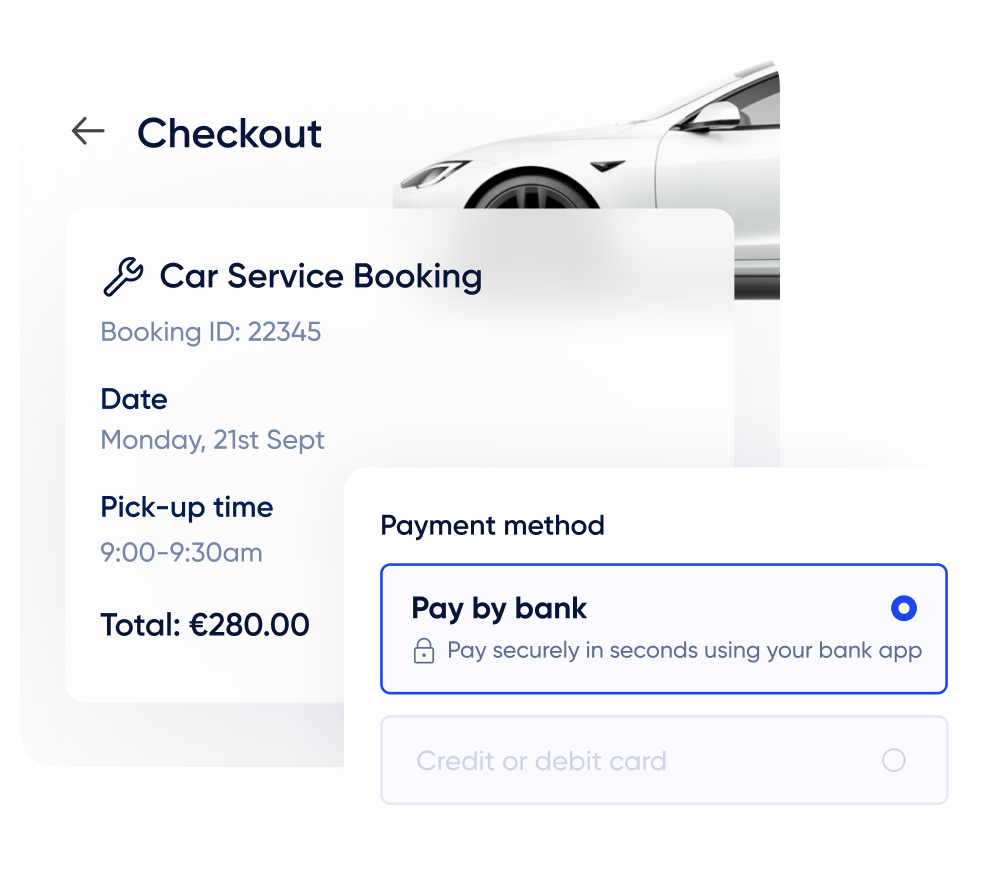

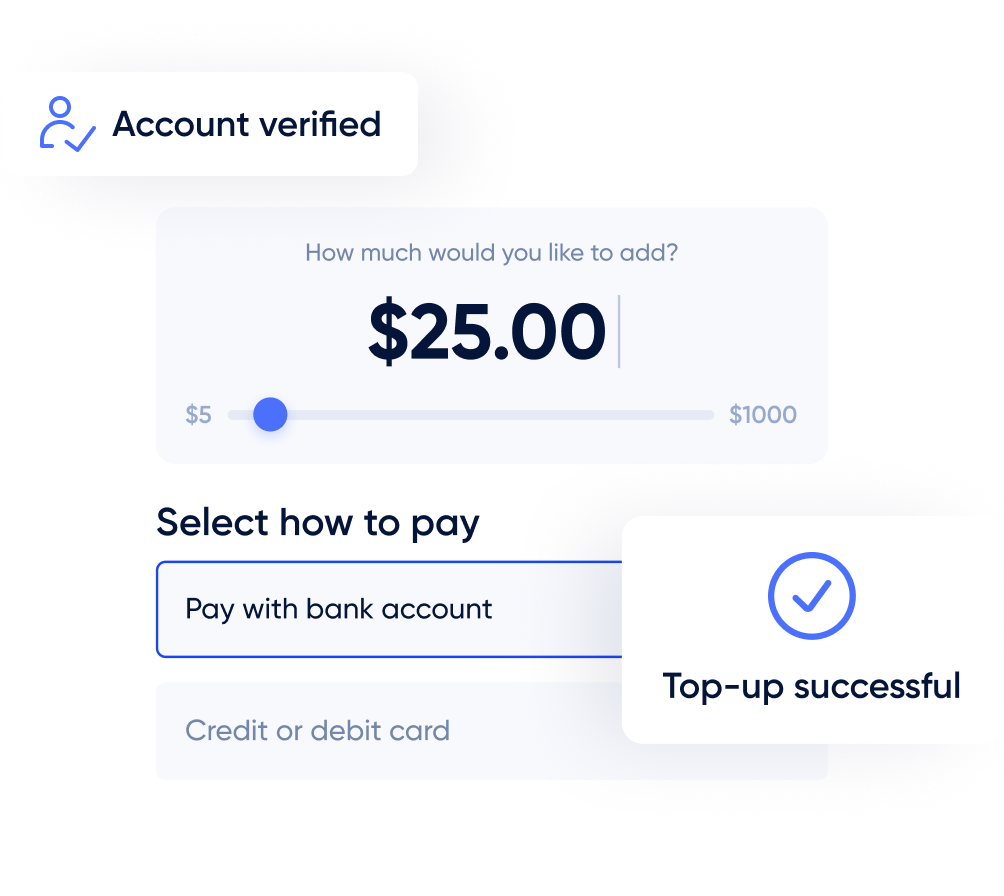

Open Banking in action

Explore how businesses of all sizes are harnessing Salt Edge’s open banking solutions to reshape their industries. From lending to iGaming, companies are unlocking real-time financial data to fuel innovation, accelerate growth, and deliver exceptional customer experiences.