Get TPP’s regulatory status checked in a split of a second

Become fully compliant and make sure that only authorised TPPs access your customers’ data.

Why you need it

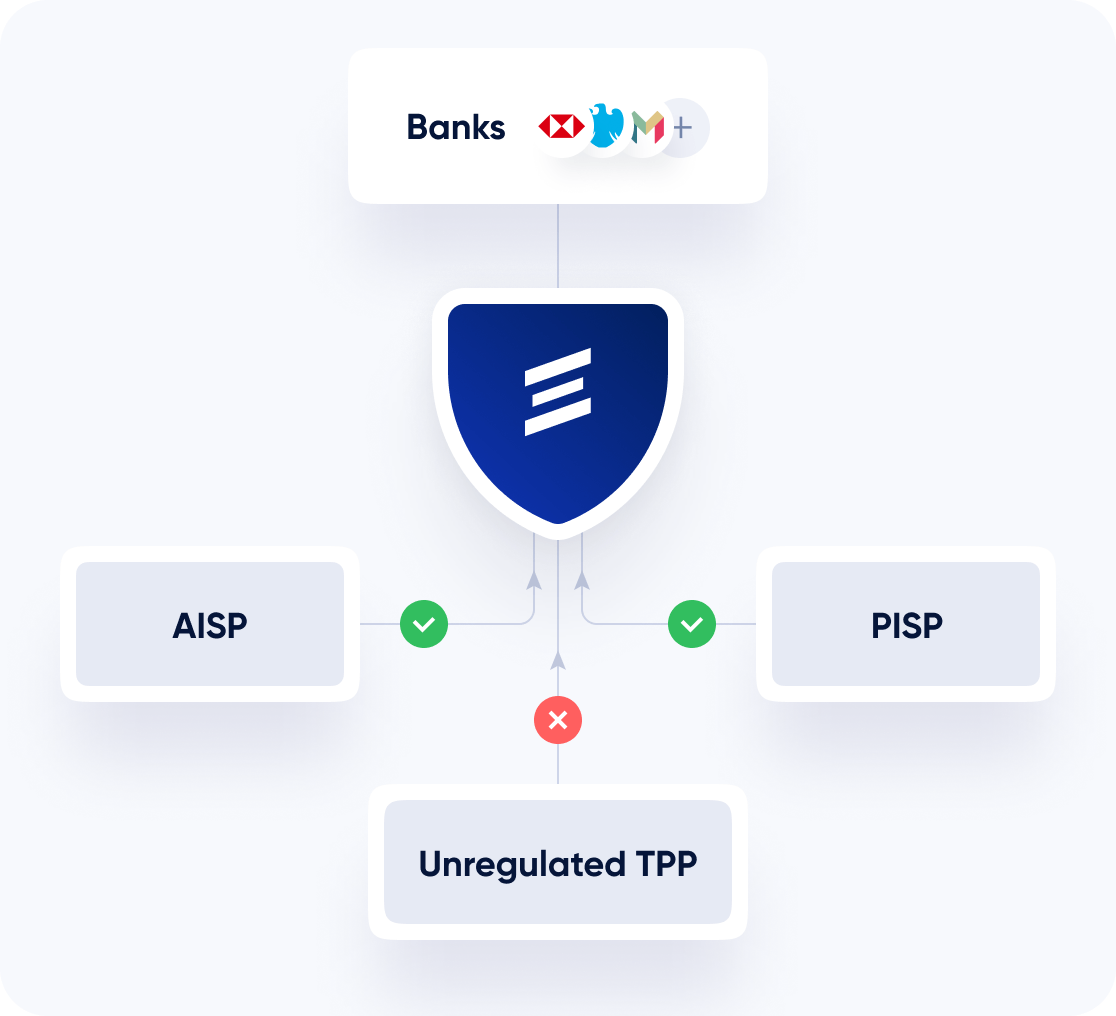

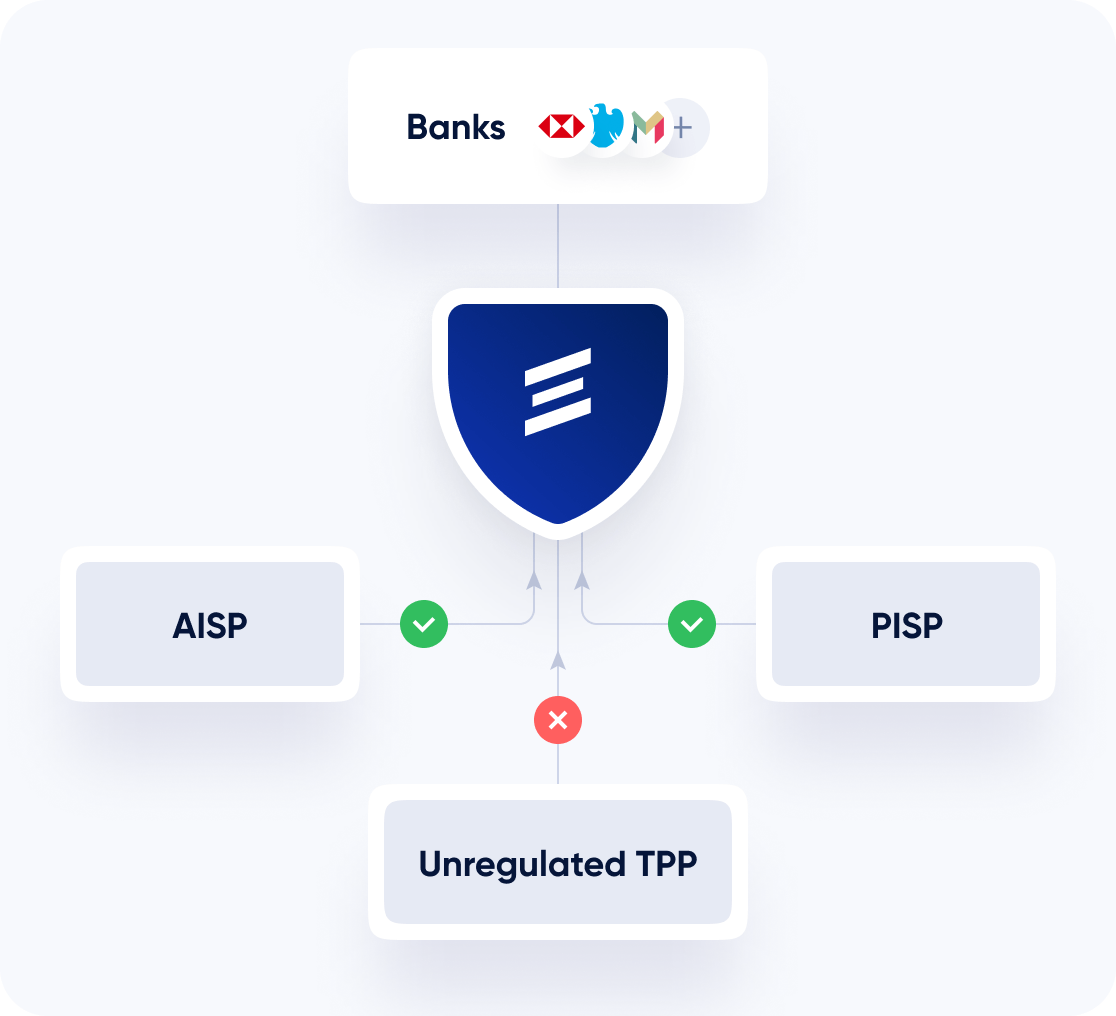

Control who connects to your customers’ accounts

PSD2 obliges banks and EMIs (ASPSPs) to open up API access for regulated and authorised TPPs. Yet, to keep customers’ accounts safe, ASPSPs must have in place a mechanism that identifies TPPs and verifies their regulatory statuses.

Salt Edge has developed a solution for banks and EMIs to check TPPs’ regulatory status and based on this info, allow only identified and trusted entities to access their APIs, ensuring no fraudulent activity takes place.

TPP checks and results you obtain

Comprehensive TPP verifications to grant security

- Checks the PSD2 role (AIS/PIS/PIIS)

- Verifies that the eIDAS or OB certificate issuer is a valid QTSP

- Checks the passporting permission

- Checks that the eIDAS or OB certificate is not revoked

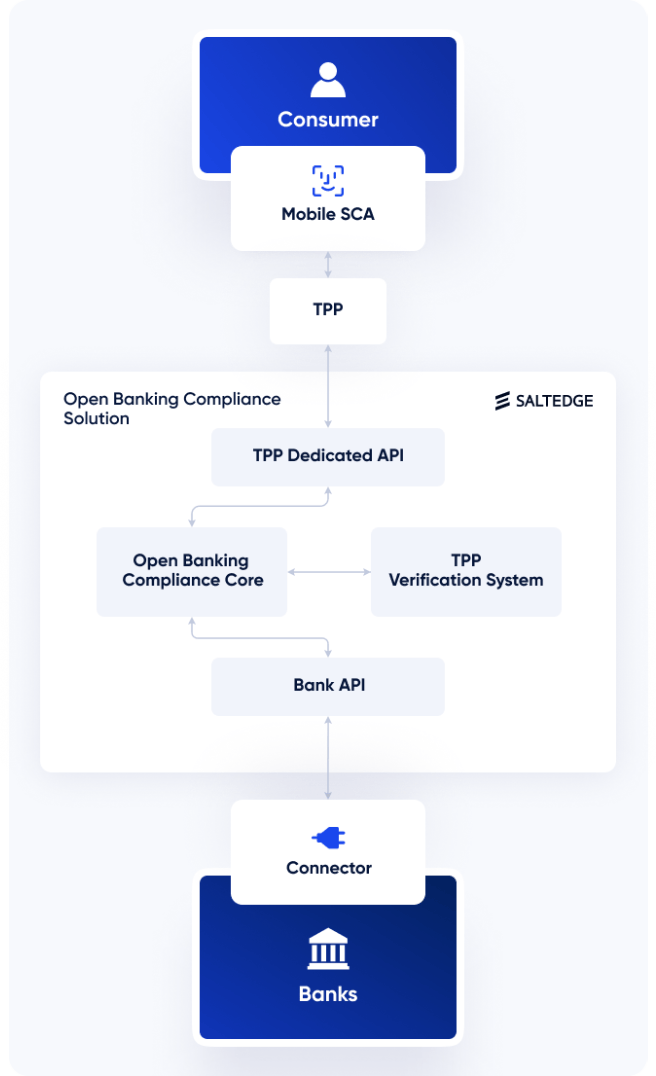

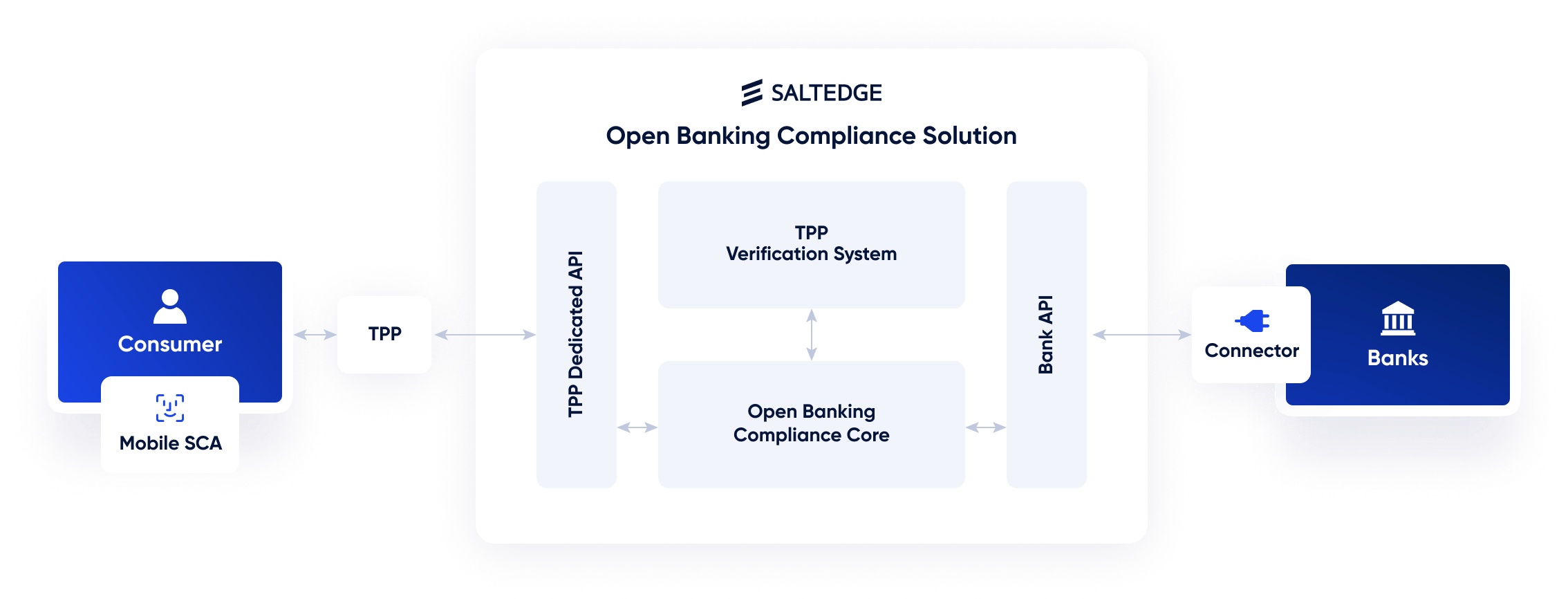

Open Banking Compliance Solution

Become fully open banking compliant in just 1 month

TPP Verification is also available as a component of the comprehensive Salt Edge Open Banking Compliance Solution. Being a cost-effective and reliable solution, it offers a targeted approach that strikes the right balance between security and user convenience, requiring minimum technical participation from the ASPSP’s side.

With Salt Edge Open Banking Compliance Solution banks and EMIs become fully compliant with strict open banking and SCA regulatory requirements in just 4 weeks.

Learn moreBenefits

Full-scale and smart

TPP verification

Comprehensive dashboard

Get the full control to see the number and speed of verifications. Monitor performance, manage team roles, and open tickets for support team

Security of your data

Salt Edge does not process the details of TPP requests (e.g. payment details), thus no personal data is disclosed to us

Compatible with any channel

Use TPP Verification system for both APIs and MCIs channels in compliance with strict open banking requirements

Highest security standards

ISO 27001 certified and AISP licensed under PSD2, Salt Edge employs the highest international security standards to access financial data from a user's bank account

We’ve got you covered

Benefit from a cost-effective compliance solution. Salt Edge handles all the technical, security, compliance matters

Fast and easy integration

Take advantage of a ready-to-use and agile SaaS solution that is easily integrated on your side. We take care of maintenance and updates

They trust Salt Edge